Majority of cryptocurrency holders are Millenials, like myself. And these millenials are able to earn at least 2X to even 50X of their investment in 1 year time. In fact, majority of those profits are in the 6-7 digits PHP or 4-5 digits USD.

Yes! There is money in Ethereum (and other Cryptocurrencies). And I will lay them out in five simple points, how these millenials earn.

1. Ethereum’s ETHER can both be treated as an Investment and a Currency

Though Ethers are designed to be currencies, millenials treat them as investments since their value appreciate (from cents a few years ago, to roughly 40K PHP by end of 2017). So buying a few now and expecting a higher FIAT equivalent in the future, like PHP or USD, will earn them profit.

But as currencies, this is where the magic really happens

2. ETHERs can buy companies

When millenials hold ETHERs, they are actually holding currencies of the future. Even though ETHERs are not yet readily accepted in exchange for everyday products, they are already accepted by some HIGH-TECH startup companies that want to develop new innovative products across the world.

So unlike now where Filipino Millenials are restricted in buying Local Stocks listed in the Philippine Stock Exchange, they are now free to invest in any startup companies in the crypto world.

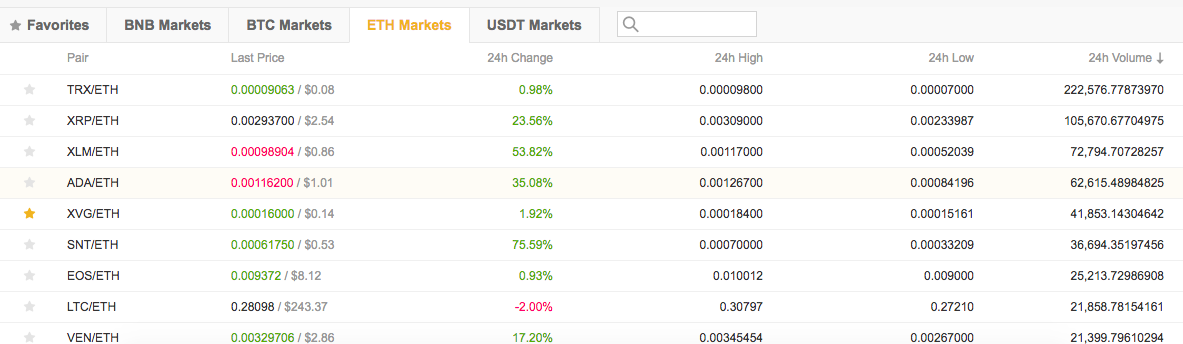

3. ETHERs are used to TRADE coins in the market.

In exchange for your precious ETHERs, companies give you their ERC-20 compatible Tokens.

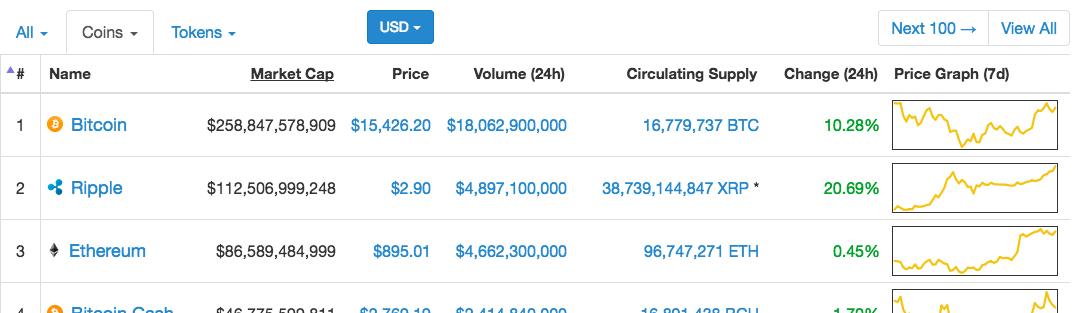

There is one best place to see all of these coins and tokens: https://coinmarketcap.com/

To differentiate the two, COINS are cryptos that act as currencies, like Ethereum, while TOKENS, act as shares of stocks. But sometimes, the word COIN is also used to refer to TOKEN.

So, it’s like a mix of both FOREX (Foreign Currency Exchange) and STOCKEX (Stocks Exchange). Coins can be traded for Tokens, and vice versa.

Note: Ethereum is a huge platform on its own, and ETHERs in fact act as gas (a powerful but technical concept we can discuss in a another blog), used to run the entire ecosystem. In this article, we are only considering ETHER‘s use case as currency apart from many others making it one of my personal pick for THE new economy.

4. The goal is to end up with more ETHs than they started off with.

Millenials are not satisfied with mere capital appreciation. It’s the hope of a new economy! So gaining more ETHs is the way to go.

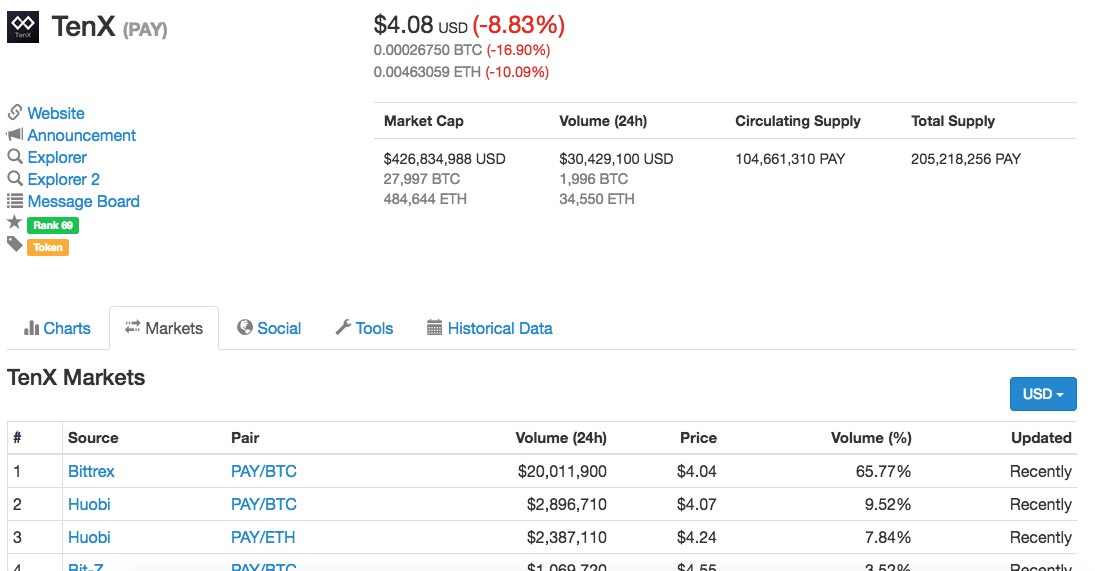

Under https://coinmarketcap.com/, we look at TenX. https://www.tenx.tech/ as an example.

TenX is a company that aims to be the Mastercard and Visa of the Crypto world. So imagine later on, going to a store that still doesn’t accept ETHs as payment, and there you have a TenX Card that converts your ETHERs directly to the store’s FIAT currency, like PHP. It’s the Millenial’s shopping credit card, only that they’re paying in ETHERs instead of PHP credit.

Now, under the Market tab, you can see that TenX is being exchanged in multiple coin exchanges, such as Bittrex and Huobi. These exchanges are based all over the world. For instance, Huobi is a Chinese Coin Exchange. You can register in any exchange where your favorite company is listed.

I personally use Binance https://www.binance.com/, because it’s very simple to use and haven’t encountered any deposit / withdrawal delays yet.

5. Crypto Exchanges are on Steroids

Millenials are never happy with a 10 to 20 percent return in a year in local stock exchanges. They want MORE! Their appetite for risk is a lot higher. That’s why a 40% gain in a month buying and selling companies is a highly likely scenario.

However, a negative downturn is also inevitable. I have had a coin that traded 70% less than its value overnight, just because I went out hiking and didn’t have an internet connection. That was a painful experience but nevertheless a great reminder: Trading Cryptos require a lot of your TIME monitoring your trades and doing research.

Just like any investment, you define your own level of appetite for risk. Millenials spend a lot of time checking out company profiles, scrutinizing the startup team members, products, rumors pertaining the coin, and evaluating how likely the company can turn out to be a scam.

Because cryptos are still in their infancy and are highly unregulated, a lot can go wrong. These companies can take advantage of your precious ETH, and then they disappear overnight.

The whole crypto market can be one big Tulip Mania or a Dot Com Bubble. But also remember, that inspite of the Dot Com Bubble, we still have Amazon, Ebay, and Paypal, all of which are worth Billions of USD now.

Invest carefully!

P.S. Crypto market is a highly volatile environment. It is not for the faint-hearted. You can win big, you can lose big. It is riskier than FOREX.